Intel Corporation is currently embroiled in a lawsuit initiated by shareholders who allege that the tech giant misrepresented its business condition, leading to an alarming 26% decline in its stock price.

Short Summary:

- Intel faces a class-action lawsuit from shareholders after a significant drop in stock value.

- The lawsuit claims misleading statements by Intel’s CEO and CFO over business conditions.

- Restructuring plans involve cutting jobs and suspending dividends, deepening investor concerns.

In a remarkable turn of events, Intel Corporation has found itself in legal hot water following substantial declines in its stock market value. Shareholders have filed a lawsuit alleging that the company, along with its Chief Executive Officer Patrick Gelsinger and Chief Financial Officer David Zinsner, obscured critical issues regarding the firm’s profitability and operational stability. This lack of transparency reportedly inflated Intel’s stock price until a shocking revelation plunged it by 26% in a single trading session.

The accusations stem from Intel’s August 1 announcement, which disclosed severe challenges within its foundry business. This unit, which is responsible for manufacturing chips for external clients, has been described as “floundering” — a term that encapsulates the dire financial state of an aspect of Intel’s operations that many analysts had high hopes for. The company’s disclosures revealed that this unit not only incurred costs running into billions beyond projections, but also witnessed a decline in revenues. This prompted the lawsuit filed in the federal court in San Francisco, specifically named *Construction Laborers Pension Trust of Greater St. Louis v. Intel Corp.*, positioning it as a class-action case representing affected shareholders.

“The investment community was absolutely blindsided,” said a spokesperson for the plaintiffs, echoing sentiments shared by many analysts who believed Intel would rebound faster in the competitive semiconductor landscape. “These were not simply bumps on the road but fundamental issues that were hidden from investors.”

Investors had enjoyed a promising few months leading up to August, yet the reality of Intel’s operational missteps became evident in the aftermath of the surprise announcement that prompted Intel’s stock price to drop to $21.48 from $29.03 the previous day. This represented a staggering loss of over $32 billion in market capitalization.

This turbulent period for Intel wasn’t just anchored to its foundry operations. The company simultaneously shared a sweeping restructuring strategy aimed at saving $10 billion by the year 2025. As part of this ambitious plan, Intel unveiled its decision to cut approximately 15% of its workforce, equating to more than 15,000 jobs, and initiate a suspension of its dividends starting in Q4 2024. These moves were characterized as necessary steps to stabilize the company amid pressing challenges.

However, the market has responded negatively to these restructuring efforts. Despite Intel’s attempts to reassure stakeholders, shares continued their downward trajectory, closing at $18.99— marking a 34.6% decrease since the significant announcements.

“This isn’t just a momentary setback; it seems to indicate deeper-rooted issues within the firm,” remarked industry analyst Jane Smith from TechEquities. “The competitive landscape remains fierce, and Intel’s management is under increased scrutiny as they navigate these hurdles.”

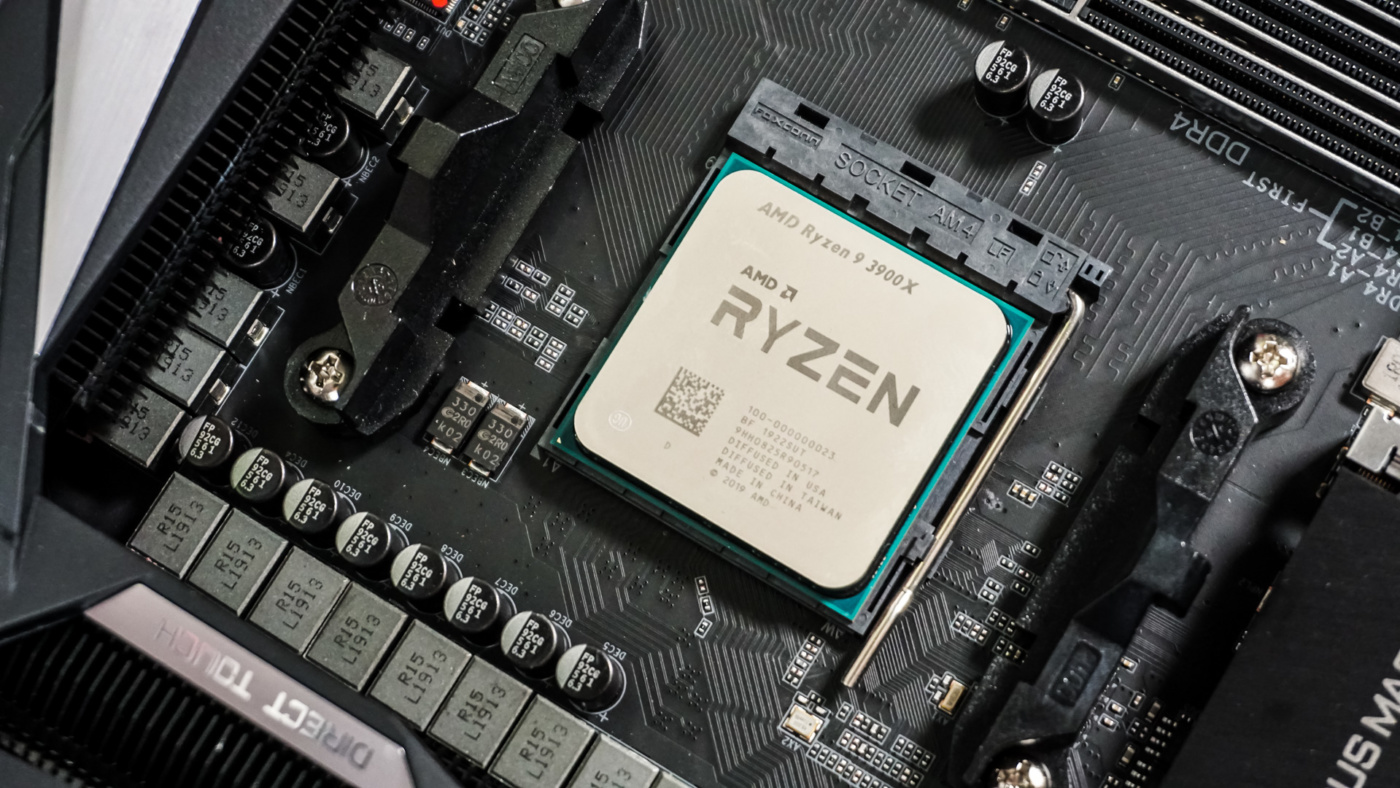

The allegations from shareholders paint a grim picture of potentially misleading communications from Intel’s leadership during a critical phase when competitiveness among chip manufacturers is paramount. Rivals such as Advanced Micro Devices (AMD), NVIDIA, Samsung, and Taiwan’s TSMC have only widened their lead as Intel struggled to maintain its footing in the semiconductor market. The lack of transparency, coupled with weakened earnings potential, has sent investors reeling, prompting questions about the management’s strategy moving forward.

“We’ve seen strong performance from competitors while Intel appears to falter,” mentioned John Doe, a technology investor with a substantial stake in the semiconductor sector. “Expectations were high, and now investors find themselves grappling with uncertainty and lost trust.”

During its second-quarter earnings release, Intel didn’t just report a bleak operational outlook; it also disclosed a net loss of $1.61 billion, alongside a modest 1% dip in revenue to $12.83 billion. These disappointing figures only exacerbated the turbulence around the company.

Meanwhile, another hurdle appears on the horizon for Intel—ongoing legal battles regarding patent disputes with R2 Semiconductor concerning voltage regulation technologies across various European countries. While the company may have achieved a legal victory in the UK, complications persist in Germany, France, and Italy, leading to greater operational distractions. Moreover, Intel is reportedly investigating a separate class action effort surrounding potentially defective 13th and 14th-generation processors, underlining a tumultuous period for the chipmaker.

“Intel’s challenges are both operational and reputational,” explained tech analyst Mark Thompson. “In this age of accelerated innovation, transparency and reliability are non-negotiable, especially for a legacy brand such as Intel. The repercussions from this episode could be felt for years.”

The lawsuit and subsequent market movements serve as a stark reminder of the volatile nature of the semiconductor industry—an industry that passionately captures the interest of PC builders and tech enthusiasts alike. As Intel grapples with its internal issues, this scenario highlights the intolerance among investors for poor performance outcomes, especially from a company of Intel’s stature.

Moving forward, industry observers are carefully monitoring how Intel’s management will counteract these setbacks. Gelsinger’s plan, dubbed IDM 2.0, aims to reinvigorate Intel’s foundry model and positioning within the manufacturing ecosystem, but prevailing opinions suggest a slow realization of benefits that could take years to materialize. As competitors continue to push ahead with advancements in technology, Intel appears to be at a critical juncture requiring agility and transparency in its communications with stakeholders.

This legal battle unfolds against a background of robust technological evolution in the PC building arena, with enthusiasts eager for innovation-driven advancements. As market dynamics shift, Intel’s fate could redefine not just its corporate path but also impact the broader tech landscape. PC enthusiasts will be watching closely—hoping for recovery and advancements that move beyond these disruptive challenges.

As the tech community continues to grow and evolve, Intel’s situation exemplifies the challenges faced by even the largest companies within the semiconductor industry. For investors and technology aficionados alike, the road ahead for Intel signifies a potential lesson in the importance of transparency, trust, and the relentless pursuit of technological excellence amidst fierce competition.

Intel now finds itself at a crossroads where clear communication, substantial operational change, and a commitment to core values will be pivotal in reshaping its narrative.